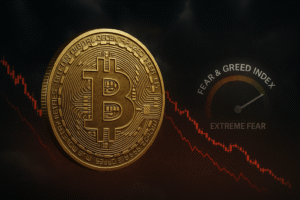

Short-term holders face increasing stress as speculative excess cools: Glassnode

Key Takeaways

Glassnode reports short-term Bitcoin holders are now facing mounting stress due to a cooling of speculative excess in the market.

The Short-Term Holder NUPL metric indicates recent buyers are sitting on increasing unrealized losses.

Share this article

Short-term holders are experiencing mounting pressure as Bitcoin’s speculative excess begins to cool, according to on-chain analytics firm Glassnode.

The Short-Term Holder NUPL, a Bitcoin metric tracking unrealized profit or loss for holders who’ve acquired coins in recent months, is signaling entry into loss territory amid ongoing market resets. Recent buyers now face growing unrealized losses as market sentiment shifts from optimism to stress.

On-chain data indicates short-term holder capitulation events are laying groundwork for potential market resets, with current stress signals emerging as a precursor to healthier market conditions.

Rapid recoveries in short-term holder metrics have historically been observed during disbelief phases of bull markets, aligning with the current cooling of speculative activity across Bitcoin markets.